Add a Car to My Insurance Founders Insurance

Founders Insurance Company specializes in difficult-to-insure customers, including those who require SR-22 insurance. The company provides auto insurance and homeowners insurance and is also known for being one of the few companies to offer liquor liability insurance. Founders Insurance is a member company of the Utica National Insurance Group.

Who Benefits Most and Least from Founders Insurance ?

Best For…

- Customers with a spotty driving history, especially those who've been turned down by other providers

- People who are looking for the lowest possible rates

- Drivers who need to file for SR-22 insurance

Not the Best For…

- Customers outside the company's relatively small service area

- Drivers looking for above-average customer service

Founders Insurance : Protect What Matters the Most

Founders has a history of providing insurance in situations when it's typically challenging to acquire, such as drivers who've been turned down by other insurers due to their driving history. The company mentions on the Founders Insurance website that it once paid a fire insurance claim based solely on photographs of the home before and after the fire.

Founders has a poor customer service rating compared to its peers. Most customer complaints focus on customer service issues and a tendency for rates to creep upwards (or sprint upwards) over time. Some Founders Insurance customers also express frustration over its website's limitations.

Founders Car Insurance Quotes and Discounts

You might think shopping for car insurance quotes means buying the cheapest option you can find, but if you're not checking for discounts, you might not be saving as much as you think. Pick a policy with lots of available discounts, and a seemingly costly premium could end up being the best deal of the bunch.

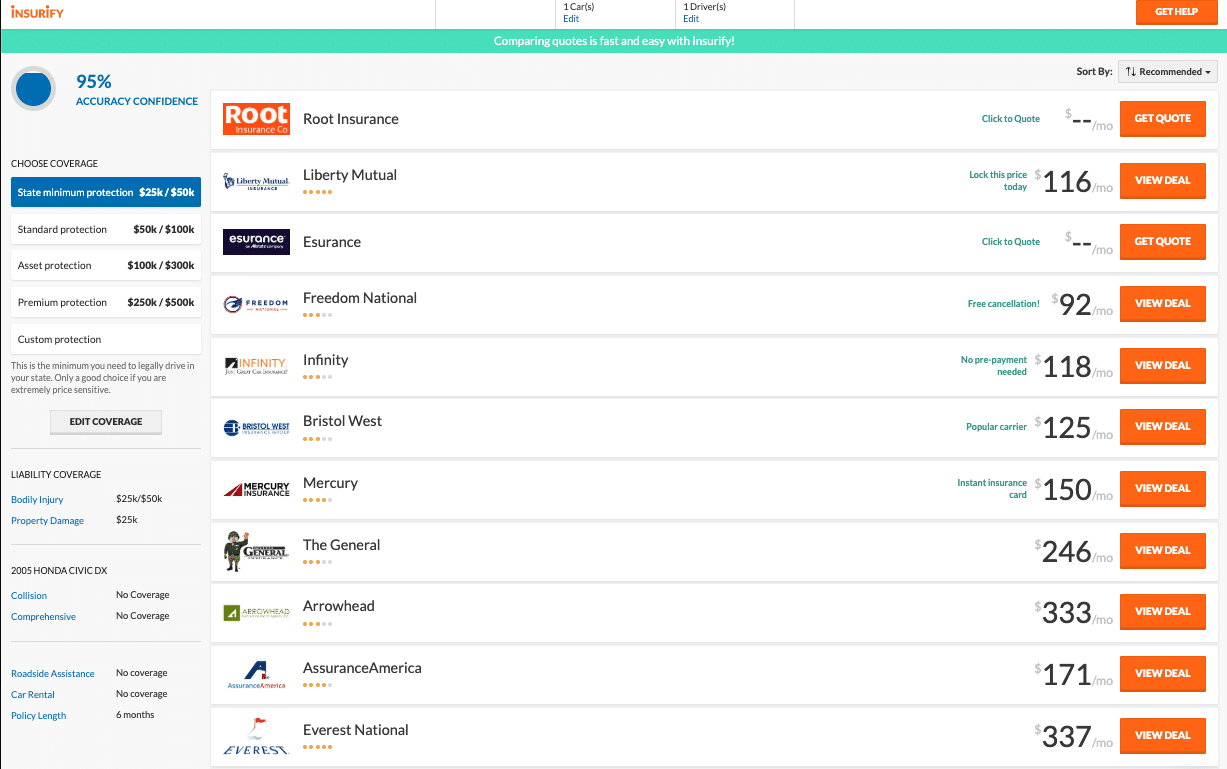

Make sure you use Insurify to compare auto insurance quotes —it makes sure you're aware of any discounts for which you're eligible and lets you compare quotes between several insurance companies !

States Where Founders Car Insurance is Offered

Founders auto insurance is available in four states.

If you live in one of the below states, Founders might be a good choice for you:

- Illinois

- Indiana

- Ohio

- Wisconsin

Insurance minimums and coverage vary in every state, so you should look up the details for Founders policies offered in yours:

Founders Auto Insurance Coverages

Founders offers policyholders the following types of insurance as part of its "standard" car insurance coverage.

Comprehensive and collision coverage

These types of car insurance coverage pay for damage to your vehicle, whether the damage is your fault or someone else's. Collision coverage pays for damage that occurs when your vehicle hits something else (be it another car or something like a tree). Comprehensive coverage is for any type of covered damage that's not the result of a collision: for example, if your vehicle is stolen or vandalized.

Liability coverage

Founders offers customers both property damage and bodily injury liability, which are mandatory in most states. These cover you if you're at fault in a car accident and need to pay for medical bills and property damage sustained by the other driver. For example, if you were at fault in a car accident with another car, Founders would pay for the damages to that other car. If you were to crash into someone's fence or mailbox, Founders would pay for that, too.

Uninsured and underinsured motorist coverage

What happens if you're in an accident that's someone else's fault, but that person doesn't have enough insurance coverage to pay for your vehicle repairs or your medical expenses? In that case, Founders' uninsured or underinsured motorist coverage can help.

If you're hit by someone who has no insurance coverage or you're the victim of a hit-and-run, uninsured motorist coverage will apply. Underinsured motorist coverage, not surprisingly, is for accidents where the at-fault driver has some insurance coverage, but not enough to pay for all the expenses. Some states require this coverage on your auto insurance policy, while others consider it optional.

Medical Payments coverage

If you're involved in an accident, Founders' medical payments coverage will help pay your medical expenses, legal fees, and any emotional distress the accident caused you. Medical payments coverage is not intended as a replacement for health insurance, but it can complement your existing health insurance coverage. For one thing, your health insurance will help with your medical costs from an accident but it won't do a thing for your passengers, whereas your medical payments coverage extends to everyone in your vehicle.

Personal Injury Protection coverage

Founders offers Personal Injury Protection (PIP) coverage as your state requires. If you're a resident of a no-fault accident state, you're required to have either medical payments coverage or PIP coverage. PIP covers your medical payments in the long-term aftermath of your accident, not just the immediate aftermath. This means if you or your family members sustained injuries that require regular hospital visits and rehabilitation, PIP would cover those costs. PIP tends to cover more expenses than medical payments coverage does, but unlike medical payments coverage, you'll have a deductible to meet. Check to make sure you're comfortable with the level of PIP coverage before purchasing your insurance policy.

Other Special Auto Coverages Offered by Founders Insurance

Foreign License Coverage

If you have a valid driver's license issued by a country other than the U.S., Founders may be willing to offer you auto insurance coverage.

SR-22 and FR-44

If you've been convicted of a major traffic violation, including DUI, driving without insurance, or anything resulting in license suspension, your state may require you to get a special certificate proving that you have at least the minimum required insurance coverage. This certificate, which your insurance company will file with the state, is called an SR-22 (in a few states, this document will have a different name; for example, in Florida, it's an FR-44). Not all insurance companies are willing to file this document for you, but Founders will do so.

Other Insurance Products Offered by Founders Insurance

Home Insurance

Dwelling protection, personal possession protection, liability coverage, and loss of use coverage are standard inclusions for homeowners insurance policies. Founders offers HO-3, or "special form" coverage, on houses up to 100 years old. Despite the name, HO-3 is the most common type of homeowner's insurance and covers the most common perils and more. Owners of older homes can instead get an HO-8 policy from Founders, the aptly named older home insurance that's designed explicitly for such houses.

Renters Insurance

If you rent rather than own your home, Founders can provide renters insurance that includes personal liability coverage, personal property coverage, medical payments coverage, and replacement cost coverage. Bundle auto and renters insurance is also a cost effective option.

Condo Insurance

Founders offers a variant of homeowners insurance for condo dwellers that covers everything inside the apartment, including walls, floors, ceilings, and attached fixtures. It also protects the owner's possessions inside the unit, with limitations similar to a standard homeowners insurance policy.

Commercial Auto Insurance

Using a vehicle for business means you'll need to get commercial auto insurance to protect it during those times, even if it's your personal vehicle. Note that this is not rideshare coverage, which is a specialized form of commercial auto insurance . Founders specializes in snow plowing and landscape coverage but can provide policies for a wide range of business driving needs.

How Can I Buy Auto Insurance from Founders?

You can purchase Founders' car insurance by calling a Founders agent at a local insurance agency; there's a search tool on the Founders website.

Speaking with an independent insurance agent is the only way to get a quote for Founders' insurance policies (though once you have a policy, you'll be able to manage it using the website). Remember to compare quotes before you make a decision by using a website like Insurify , which lets you compare up to 20 quotes at a time!

How Can I Pay for My Founders Car Insurance Policy?

Founders accepts almost all methods of payment, including paying online, by phone, or through the mail.

Credit card or bank account

You can log in to your Founders account and pay with your credit card or your checking or savings account. Alternatively, Founders allows you to skip the login and make a one-time payment if you provide your policy number and the current amount listed due on your last policy statement.

Through your bank

You can sign up for online payments through your bank by using your Founders policy number. To get set up, you'll also need your bill amount and due date. Use the following payment processing address:

Founders Insurance Group

P.O. Box 5040

Des Plaines, IL 60017-5040

Once you've completed the setup process, you can easily make future payments through your bank's bill pay system.

By phone

Call 1 (847) 768-0040 to pay for your policy over the phone. The line is manned between 8:00 AM and 5:00 PM Eastern Time Monday through Friday, and 8:00 AM to 1:00 PM on Saturdays.

By mail

You can send a check or money order to the following mailing address:

Founders Insurance Group

P.O. Box 5040

Des Plaines , IL 60017-5040

How Often Will Founders Increase My Premiums?

If you get into an accident…

Even safe drivers can get into unfortunate situations, and most of the time, getting a ticket or a violation on your record will lead to premium increases. In fact, your auto insurance rates will most probably increase even if you weren't at fault in the accident.

If you're a loyal customer…

Many Founders policyholders complained of price hikes even though they had maintained clean driving records. It's wise to compare rates with other insurance providers every time your policy is up for renewal, even if your rates with your existing insurance provider don't change.

If you file a claim…

The number of claims you file will also impact your Founders premiums. If you file a claim, even for an accident where you weren't at fault, your Founders rate will probably increase.

How Does Founders' Claims Process Work?

You can file a claim online by logging into your Founders account online and following prompts. You can also call 1 (888) 676-4342 if you would rather speak to a representative. Once you've filed a claim, you can manage and track its progress online by entering the claim number and policy number or call 1 (888) 676-4342 for updates. Note that the claims phone number is staffed on Saturdays, but only for reporting new claims.

How Can I Cancel My Founders Car Insurance Policy?

You can call your local agent or speak with a Founders Insurance representative at 1 (847) 768-0040 to cancel your policy.

Cancellation fees vary by state and policy, so you should consider canceling your policy at the end of the policy period to avoid such fees. Make sure you already have another insurance policy lined up for your car so there are no gaps in your insurance. You'll also want to hold off on canceling your plan until you have your proof of insurance letter. Use an insurance comparison website like Insurify to find and compare auto insurance quotes for free.

How Much Does Uber/Lyft Coverage Cost with Founders Insurance ?

Founders Insurance does not offer ridesharing insurance , just standard commercial auto policies. A ridesharing policy covers you during the time between when your personal coverage from Founders Insurance ends and your Uber or Lyft policy takes over. You'll still need to buy coverage from Uber or Lyft to protect you while you actually have a paying passenger in the car; a rideshare policy is only active between when you log into the Uber/Lyft app and when you get matched with a passenger.

Because the ridesharing coverage only operates for a brief window, it's typically quite affordable—though specific costs will vary based on your driving history, location, credit score, and other factors.

Insurance Companies Similar to Founders

According to Insurify's internal database of over 2 million car insurance applications and analysis of external sources, people who previously held Founders auto insurance policies most often switched to the following companies:

- Dairyland

- Liberty Mutual

- SafeAuto

- Progressive

Founders Car Insurance Customer Satisfaction and Policyholder Reviews

Customer reviews for Founders are relatively poor. Positive reviews are few and far between:

Meanwhile, negative reviews are mostly from those unhappy with Founders' claims process, which many have found unsatisfactory and unhelpful:

Frequently Asked Questions: Founders Car Insurance

Does Founders have good insurance?

Founders Insurance is a good option for car insurance if you're considered a high-risk driver, if you are highly price-conscious and want the lowest possible rates (Founders' premiums tend to be lower than those of its competitors), or if you need to file an SR-22. It might not be a good option if you're looking for superb customer service (although the latter partly depends on the caliber of your local agent), and definitely not if you live outside the four states where Founders provides coverage.

How do you know if Founders is the cheapest car insurance in your area?

Shop around for insurance with an auto insurance quotes comparison site like Insurify to have a look at all the cheapest car insurance quotes and discounts for which you may be eligible. You can never rely on one insurance company to give you the best or the cheapest quote. Different insurance companies use different factors to set their rates, so even if a particular insurance company gave your friend a great rate that doesn't mean it will be the best deal for you. That's why it's important to do your research and compare quotes among other insurance companies.

Is Founders cheaper than Progressive or GEICO?

You can never rely on one insurance company to give you the best or the cheapest quote. Different insurance providers use various factors to set their rates, so even if Founders gave your friend a great rate, that doesn't mean it will be the best deal for you. That's why it's essential to do your research and compare quotes among other insurance companies. This can be time-consuming, but Insurify helps you compare auto insurance quotes in a matter of minutes. All you have to do is put in some basic information about your driving profile, and you can compare up to 20 free quotes at once!

Is Founders the best cheap car insurance in your area?

Comparing cheap car insurance quotes used to be time-consuming…if not entirely impossible. That's why Insurify stepped in to help you take the process back into your own hands.

Insurify helps you compare auto insurance quotes in a matter of minutes. All you have to do is put in some basic information about your driving profile, and you can compare up to 20 free quotes at once!

Founders Auto Insurance Overview

Founded in 1901 (then known as Mutual Fire Insurance Company ), Founders Insurance Company has been providing coverage for over 100 years. Founders Insurance is currently headquartered in Des Plaines , Illinois , which is in the greater Chicago area.

Founders Insurance specializes in non-standard auto insurance for customers living in Illinois , Indiana , Ohio, and Wisconsin .

Founders Insurance is unusual in that it offers coverage for liquor liability and special events in eighteen states in the United States . According to its official website, Founders covers liquor liability for special events with up to 5,000 in attendance, as well as liquor license-eligible venues, including:

- Bars/taverns/ nightclubs

- Adult entertainment clubs

- Restaurants/banquet halls

- Private, fraternal, and social clubs

- Liquor, convenience, and grocery stores

- Golf courses/country clubs

- Hotels/Motels

- Bowling alleys

- Distributors

- Caterers

- Pool halls

- Sports venues

A.M. Best , a credit rating company that assesses the financial strength of insurance companies , gives Founders Insurance an "A-," denoting excellent financial health and ability to pay out claims.

| Customer service phone number | 1 (847) 768-0040 |

| Claims phone number | 1 (888) 676-4342 |

| Tech support phone number | 1 (866) 758-7678 |

| Billing and underwriting phone number | 1 (847) 768-0040 |

| Fax number | 1 (847) 795-0080 |

| Account login | Login |

| Mailing address | Founders Insurance Group, P. O. Box 5040, Des Plaines, IL 60017-5040 |

| Claims address | Founders Insurance Group, P. O. Box 5100, Des Plaines, IL 60017-5040 |

| Headquarters address | Founders Insurance Group, 1350 E. Touhy Ave., Suite 200W, Des Plaines, IL 60018 |

Updated July 26, 2021

Wendy Connick is the founder and owner of Connick Financial Solutions, a provider of tax and bookkeeping services and a QuickBooks Online Certified ProAdvisor. A long-time freelance writer, she specializes in business and finance articles on subjects including taxes, investing, and retirement. Wendy is an Enrolled Agent (EA), the only federally licensed tax practitioners who specialize in taxation and have unlimited rights to represent taxpayers before the IRS. She is a member of the National Association of Enrolled Agents and a certified volunteer for VITA (Volunteer Income Tax Assistance), an IRS-sponsored program to provide free tax help for low-income individuals and families.

Add a Car to My Insurance Founders Insurance

Source: https://insurify.com/blog/car-insurance/founders-review/

0 Response to "Add a Car to My Insurance Founders Insurance"

Post a Comment